Rightmove's latest House Price Index for London has some interesting data that should provide some encouragement for those looking to purchase their first property.

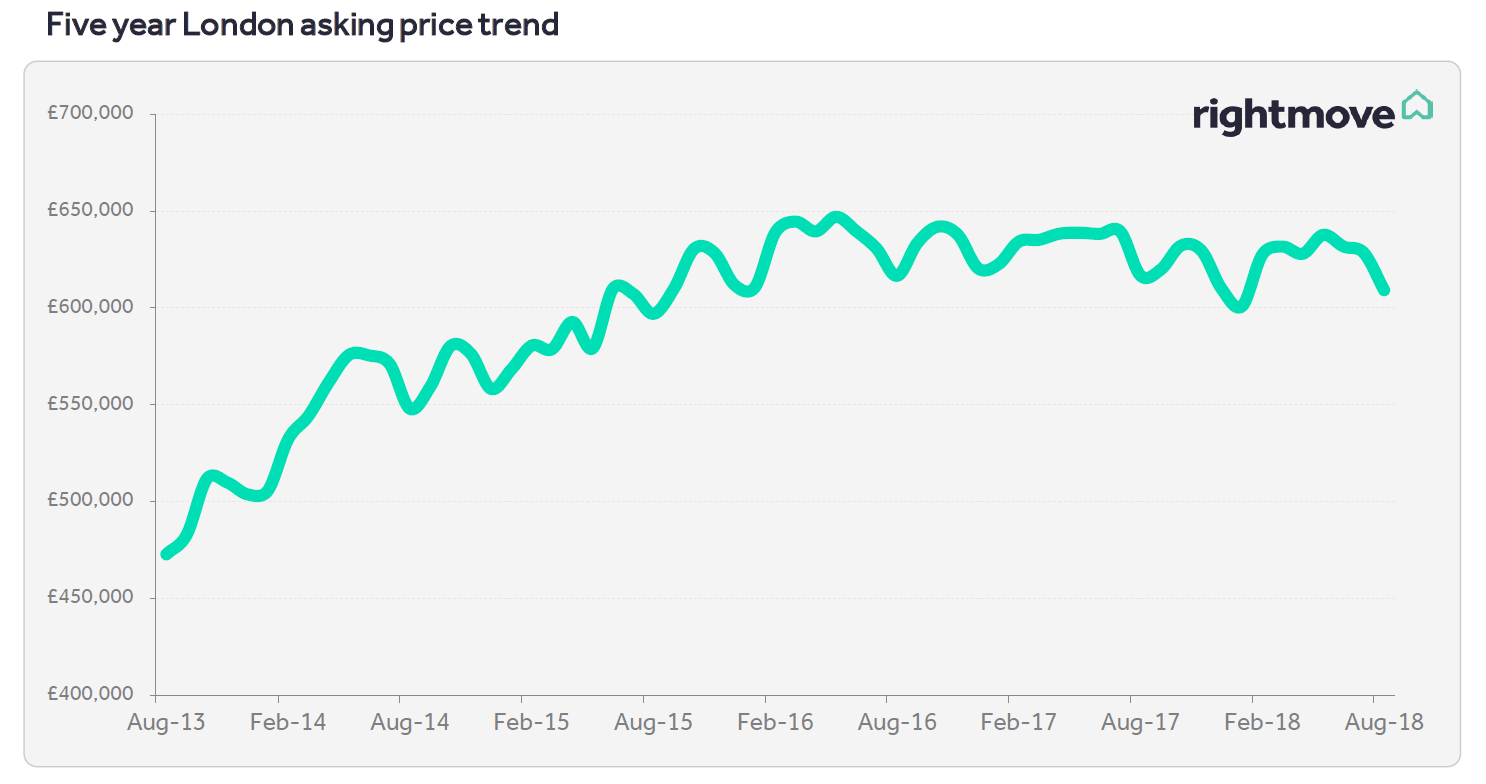

As has historically been the case for London, the price of properties coming to market has seen its common annual fall. However, this is not linked with any other shifts or current trends in the market; instead, it comes as a direct consequence of sellers undercutting their competition when coming to market during the peak summer holiday period.

“Sellers who come to market in the peak holiday month often have a pressing need to sell and price down accordingly,” offered Rightmove director Miles Shipside. “August last year saw a higher fall of 3.6%, so it could be said that this year’s 3.1% drop represents a glimmer of year-on-year improvement in London’s re-adjusting housing market. This drop is exacerbated by owners of more expensive homes being more financially robust than owners of cheaper property and consequently having the option of being able to delay their property marketing until the busier autumn period.”

First-time buyers have been provided with an interesting opportunity due to the price fluctuations of London’s market, with newly-marketed property in their typical target sector of two bedrooms or less now at its lowest asking price since July 2015. Buyers would be looking at an average asking price of &477,421 at present, which represents a 6% drop from its April 2016 peak of &506,755. Part of this is down to landlords and investors leaving the market, which all contributes to a situation where first-time buyers are able to purchase a property at a cheaper price than at any point during the last three years.

“The cheapest sector made up of properties typically bought by first-time buyers, investors, and landlords has fallen by 1.8% this month resulting in a three-year asking price low” Shipside observed. “The fall has been exacerbated by investors and landlords exiting rather than entering the market as falling capital values and a raft of tax changes put off potential investors. Prices in this sector are still very high by national standards, and aspiring first-time buyers still need a high income and a substantial deposit, but the withdrawal of many investors and landlords has helped to lower average prices in this cheapest sector. First-time buyers who can afford to buy have an opportunity to do so at a cheaper price than at any time in the past three years, which will have been one of the goals of the Government when they started to load the dice in favour of London’s first-time buyers and against landlords and investors.”

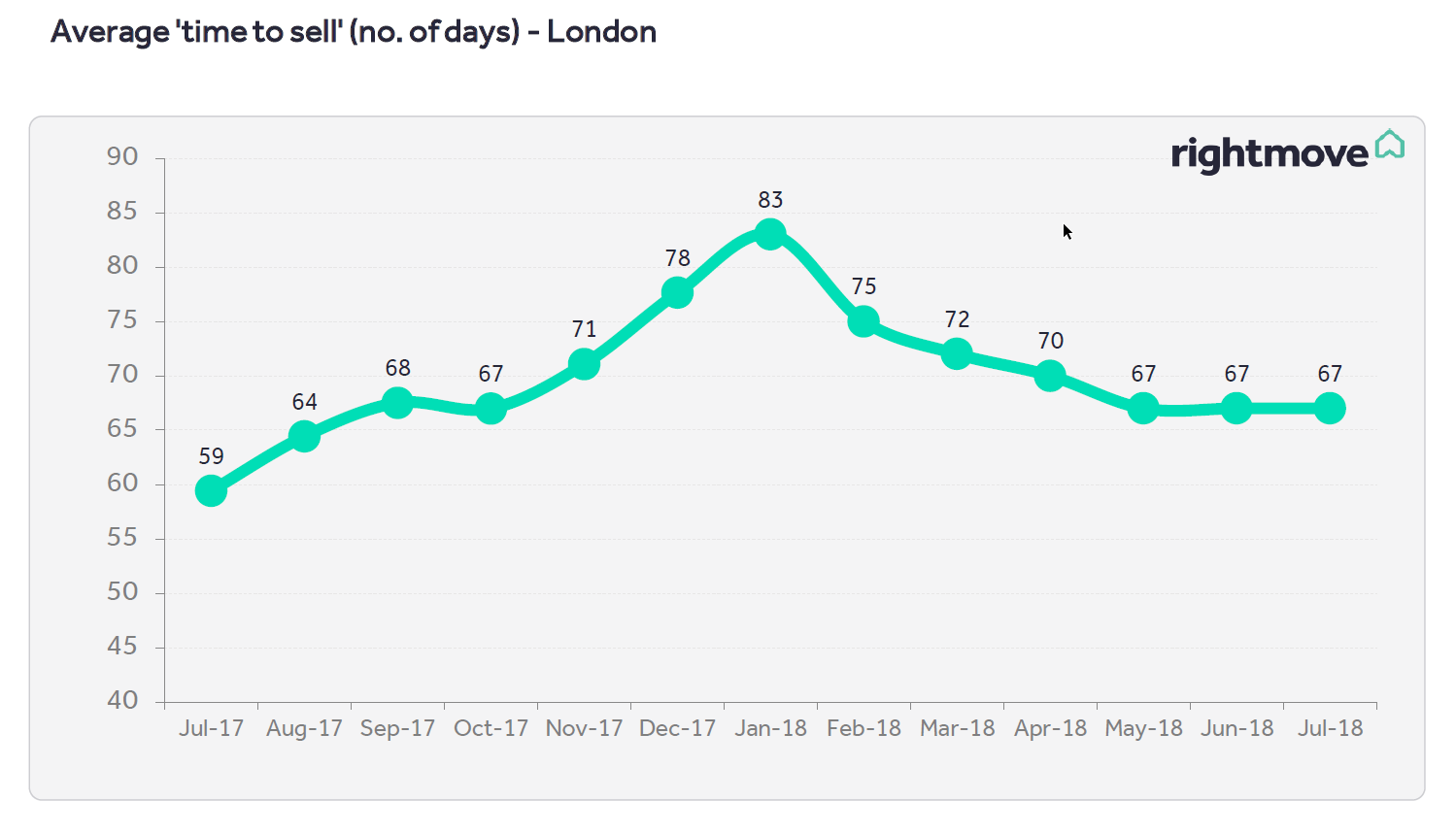

The market’s Time to Sell has maintained its steady course, with the average number of days that it takes to sell a home in London staying at 67, as it’s been since May:

Despite the drop in prices being put up for sale, the data suggests a healthy market that offers plenty of encouragement to first-time buyers to take their first steps on the property market.