Southwark’s rental market has continued to prove itself to be a safe bet for investors, with figures showing the borough to have outperformed its neighbours and the wider UK rental market.A recent insight report by Hometrack found that the UK’s rental market experienced a muted performance in the first quarter of 2018, with insight director, Richard Donnell, stating that the removal of stamp duty for first-time buyers and increased mortgage affordability has galvanised tenants into buying property. Additionally, Property Wire has reported that at the end of Q1, asking rents for properties in Great Britain fell by 0.2%.Whilst the first three months of 2018 saw the number of achieved rents in Central London fall by 4.5%, Southwark experienced a 1.1% rise. Additionally, there has also been an 8.6% rise in the number of transactions that have taken place in Q1 of 2018 when compared to Q4 of 2017.

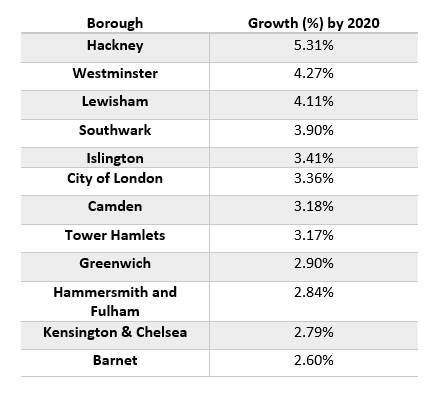

In terms of discounts given during the negotiation phase, tenants have seen their ability to haggle for a good deal reduced slightly, with the average discount given in London falling from 8.2% to 6.4%. Southwark’s landlords drove a harder bargain, only giving a 4.2% discount on the initial asking price.The supply of rental property in Southwark has remained constrained with an 11.9% fall in the number of available tenancies, however, this is due to tenants being more comfortable with the idea of staying put or renegotiating – giving landlords the opportunity to develop lucrative, long-term relationships with their tenants. Thanks to its centralised location and wealth of amenities it is no surprise that prospective tenants are struggling to find vacant properties. The Future of SouthwarkResearch performed by Barclays Bank revealed that 79% of buy-to-let landlords plan to add one or more properties to their portfolio over the next five years. If you number yourself amongst that statistic then it is vital that you understand the direction your chosen borough is heading in.KPMG recently examined rental yields and price growth across London boroughs, in an effort to predict the overall growth of property values in London. Their research found that the Borough of Southwark is set to see higher than average growth by 2020, with a predicted rise of 3.90%.

Considering that most experts are predicting a conservative 2% growth in the run-up to Brexit, Southwark looks to be outperforming even the most pessimistic of outlooks.

If you are looking to sell or let in London, then Coldwell Banker Southbank’s “7 things to know before you instruct an Estate Agent” will be insightful. Reply to this e-mail or call us on 0203 600 1906 to request your free complimentary guide today.