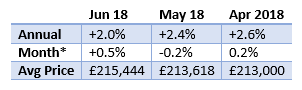

Whilst London is the only region of the UK to see house prices fall in 2018, according to the latest property index from Nationwide property prices have experienced positive growth during June.

Additionally, prices in London are currently 50% above their pre-recession peak, whilst the rest of the UK’s property market is only 15% higher.

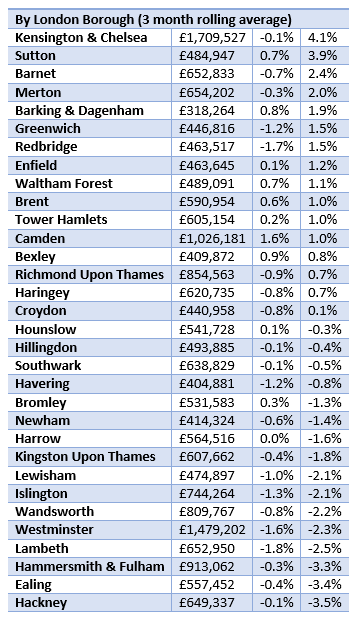

According to Rightmove, the number of properties coming to the market has risen by 8.6% over the last year, but with no corresponding increase in the number of buyers. This has led to the number of properties per agent branch reaching their highest numbers since September 2015.

Data collected in the same study shows that asking prices across London are coming down, which is good news for first-time buyers and investors who could potentially seize this opportunity to purchase property at a slightly reduced price. Prices in Southwark and Lewisham have proved to be resistant to the current condition of the property market, with house prices only seeing slight reductions.

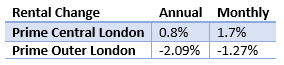

Knight Frank recently released their Prime London Residential Update. Their sales data corroborates with Rightmove’s however, their analysis shows that many homeowners are choosing to repurpose their properties as a rental rather than sell. Knight Frank’s rental data also paints a positive picture for London.

Due to the number of new properties coming to the rental market, the annual rental change has seen positive numbers for the first time since 2016. Demand has risen as supply has declined, with the ration of tenants to available lets currently sitting at 4:6.

Is there a way to solve London’s house price problems?

London’s main problem at the moment is that lack of supply has pushed prices up, which means many prospective buyers can’t afford them, leading to stagnation in the market. According to Savills House Sector Survey 2018, nearly two-thirds of the housing industry believe that the main priority for London should be to increase stock. The majority of the industry also believes that renting is the optimum route for getting as many people as possible into homes.

With schemes such as build to rent and buy to rent quickly gathering traction, there is currently an opportunity for landlords and developers to invest their money in the industry and assist in relieving the stress on the London property market.

It isn’t all doom and gloom for homeowners: house prices have risen by 300% since the start of the century

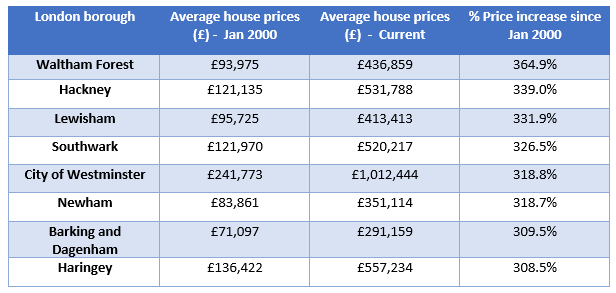

We are only 18 years into the millennium and already the housing market in southern London has undergone a dramatic transformation.

According to data from the Land Registry and analysed by HouseSimple, house prices across the UK have experienced an average 250% rise over the last 18 years. As can be expected, house prices in London outperformed the average, with property prices in Lewisham, Westminster and Southwark all seeing the value of property rise over 300% over the last 18 years.

The results are all the more impressive given that there was a recession during this time, which should have severely dampened property owner’s prospects. Thanks to the desirability of the capital’s property market, coupled with high-profile events since 2000 such as the London Olympics, it’s no surprise that London’s property market takes the top eight spots on the table.

Additionally, recent data from LonRes has revealed that flats in areas such as Southwark and Lewisham are currently turning a profit when sold on the market. Considering that London is currently popular with landlords, those that own flats and are looking to move up the property ladder or sell off their portfolio could make a profit from putting their property market.